Beware banks’ steep instant payment charges

You could be charged as much as R50 when paying someone R3 000.

Many account holders will be surprised to discover just how expensive an ‘instant payment’ or ‘real-time payment’ to another person at a different bank really is.

Because a transfer to another bank tends to only reflect the next business day, these types of immediate payments are common when one needs to transfer R5 000 urgently to a family member, or to make an urgent payment for second-hand goods you’ve bought from a neighbourhood WhatsApp group.

These charges are typically not disclosed within the banking app at the time of making the payment, so most customers simply don’t know how much they paid. The reality is that many banks in South Africa charge as much as R50 for an immediate payment.

These payments use an older framework between banks to enable real-time clearing (RTC) or interbank immediate payments. Typically, transactions take less than 60 seconds, but there can be delays.

A new payment solution, PayShap, was launched in 2023 by the then BankservAfrica (now PayInc) as a more cost-effective way to achieve real-time payments between bank accounts.

This has seen some banks – notably Absa, Standard Bank and Discovery Bank – switch their instant payment routing to PayShap and introduce a flatter fee structure, especially for lower value payments.

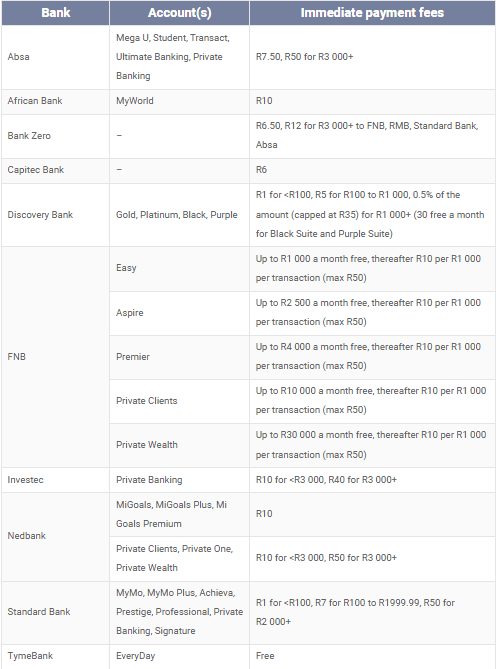

Still, there is a broad divergence in what account holders at various banks could be charged to make an immediate payment.

ALSO READ: This is how to beat bank fees

Priciest charges

Standard Bank (across all its accounts from MyMo to Signature) uses the same structure: R1 for payments under R100, R7 for payments between R100 and R1 999.99 and R50 for those over R2 000.

Nedbank charges a fee of R10 for a payment, unless in the case of Private Clients or Private Wealth customers, the payment is over R3 000, in which case the charge is R50.

This makes these accounts the priciest in the country for larger value payments.

Absa also uses the same pricing structure across its accounts (from Mega U to Private Banking) of R7.50 for immediate interbank payments of R3 000 or less, and R40 for anything greater. It has, however, switched the default for these kinds of payments in its app to PayShap where the charge is R7.50 (if paid to an account).

Investec’s fees on its Private Banking account are comparable at R40 over R3 000 and R10 for payments under that amount.

At Discovery Bank, Gold, Platinum and Black transactional account holders pay R1 for instant payments under R100, R5 for those between R100 and R1 000 and 0.5% of the amount for anything over R1 000, but this is capped at R35. Black Suite and Purple Suite customers get 30 free instant payments a month.

ALSO READ: Additional charges for using other banks’ ATMs are back

Bundled payments

FNB this year introduced an included bundle of real time payments across its five main accounts, which includes PayShap, instant payments and pay & clear now transactions to other banks.

A certain monthly allocation is included, whereafter clients are charged R10 per R1 000 per transaction.

For Easy accounts, real time payments up to R1 000 a month are free, for Aspire accounts, this is R2 500; for Premier accounts, R4 000 of transactions are included; and for Private Clients and Private Wealth accounts the included amounts are R10 000 and R30 000 a month respectively.

ALSO READ: FSCA to investigate banks charging different amounts for the same product

Cheapest of the bunch

The four cheapest banks for these types of transactions are – to no real surprise – Capitec, African Bank and the two neo banks, TymeBank and Bank Zero.

The latter charges R6.50 or R12 for a payment of more than R3 000 to an FNB, RMB, Standard Bank or Absa account.

African Bank charges a flat fee of R10 (which makes it pricey for smaller value payments), while Capitec Bank charges R6 for an immediate payment to any bank (down from R6.50 in 2024).

At TymeBank, immediate payments under R5 000 via PayShap (via a PayShap ID, not account number), are free.

This article was republished from Moneyweb. Read the original here.