Bank of the wealthy: CEO costs R76m, staff earn R22k

There is no bank in South Africa that offers less than R20 000 per month as minimum pay.

Investec, one of South Africa’s private banks and wealth management firms, has given its minimum pay for employees a bump and decreased its group CEO’s remuneration package.

Investec is a Johannesburg Stock Exchange (JSE) listed company and, under the Companies Act 71 of 2008, a publicly listed company must disclose the amounts its highest- and lowest-paid employees earn.

Usually, companies would disclose their minimum pay and give a breakdown of how much the CEO and CFO earned.

ALSO READ: They collect your tax and earn R33 million while doing it – Meet Sars’ top earners

Investec R76 million payday

The group’s target market is high-income earners, professionals, entrepreneurs, and businesses that need tailored financial advice, investment opportunities, and exclusive banking services. This is often why it is seen as a bank for the wealthy.

It mainly operates in South Africa and the United Kingdom (UK), with the UK business being listed on the London Stock Exchange (LSE).

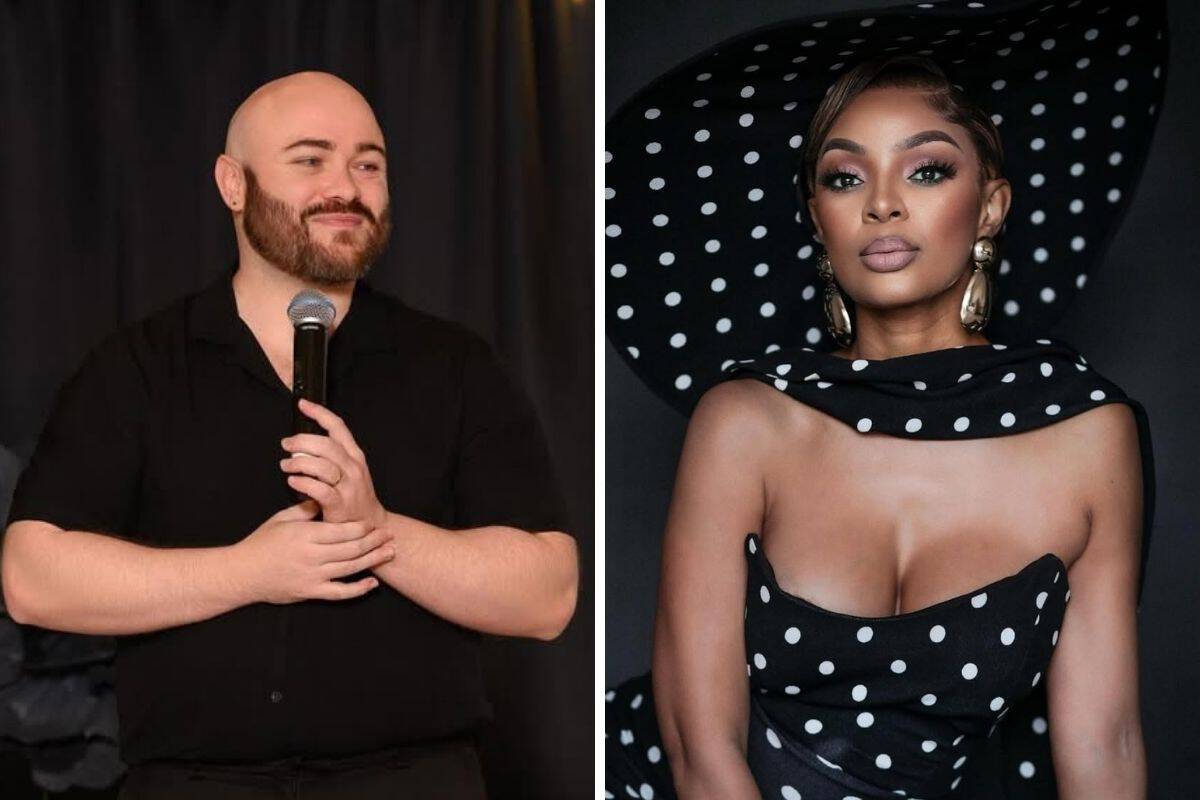

The group’s CEO is Fani Titi, who, according to Investec’s integrated report for 2025, received a remuneration package of £3 359 000 (R76 204 894 – based on the exchange rate on Monday, 10 November), a decrease from 2024’s £5 237 000 (R118 800 402,34).

Investec employees’ salaries

According to the report, Titi’s decrease in remuneration package comes amidst a volatile operating environment for the group in 2025. The group’s adjusted operating profit grew 7.8%, surpassing £1 billion (R24 billion) for the first time.

The breakdown of his remuneration includes a fixed salary of £880 000 per annum (R19 962 606,40), which is a 19% decrease from 2024’s salary. His short-term incentive (STI) for the year amounted to £1 568 000 (R35 570 675,84). While his long-term incentive (LTI) amounted to £862 000 (R19 555 176,84).

According to the report, Titi’s 2022 LTI was measured over three years to see if performance targets were met, in line with UK regulatory requirements.

“The award vests in equal proportions over the five-year period commencing on 1 June 2025, with an additional 12 months retention post vesting.”

ALSO READ: R90m per year: Meet Discovery Group’s highest-paid executive – and it’s not the CEO

Highest minimum pay in SA

The group offers banking, wealth management, and investment services, with its bank division in the country led by Cumesh Moodliar. Moodliar’s remuneration package is not included in the report.

However, the group said it has increased its minimum pay to more than R22 000 for its employees. “An adjustment to our minimum salary in South Africa to R273 000 per annum,” read the report.

“Within the UK, we ensure all employees are paid more than the living wage as published annually by the Living Wage Commission.”

No bank pays less than R20k

The minimum pay of R273 000 per annum seems to be in line with all the popular banks in the country, as, according to information gathered by The Citizen, there is no bank in South Africa that pays less than R20 000 per month.

- FirstRand minimum pay – R260 000 per year

- Standard Bank’s minimum pay – R258 390 per year

- Absa’s minimum pay – R250 000 per year

- Nedbank’s minimum pay – R240 000 per year

NOW READ: Meet the province where most of the budget goes to government salaries